30+ How much can 8 borrow mortgage

Heres a breakdown of what you might face monthly in interest and over the life of a 150000 mortgage. The most common term for a mortgage is 30 years or 360 months but different terms are available depending on the type of home loan that works best for your situation.

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

That doesnt mean you have to borrow the entire amount if it would put you under significant financial strain.

. Borrow Business Loans Lines Instacap Loan - up to 100k Agricultural Loans SBA Loans Public Fund Financing. Eligibility requirements and TCs apply. Please select 5 years 6 years 7 years 8 years 9 years 10 years 11 years 12 years 13 years 14 years 15 years 16 years 17 years 18 years 19 years 20 years 21 years 22 years 23 years 24 years 25 years 26 years 27 years 28 years 29 years 30 years 31 years 32 years 33 years 34 years 35 years 36 years 37.

Check rates today to learn more about the latest 30-year mortgage rates. This can help you build a stronger future because youll be better informed and better equipped to be a successful. Over 170000 positive reviews with an A rating with BBB.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow. Table 2 shows the total interest paid over 30 years. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

Maximum additional loan term is 25 years if any element of your mortgage is on interest only. However when interest rates are rising its a different market. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan.

The idea of a 20 down payment can make homeownership feel unrealistic but the good news is that very few lenders still require 20 at closing. Youve estimated your affordability now get pre-qualified by a lender to find out just how much you can borrow. Borrowers within this limit typically receive more favourable mortgage rates.

How much can I borrow. Cash out debt consolidation options available. Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term.

Borrow from 8 to 30 years. Your total interest on a 600000 mortgage. Pay off higher interest rate credit cards pay for college tuition.

For a 200000 loan a 1 difference means you will pay an additional 35935 over 30 years. Your down payment affects how much you can borrow for a mortgage. As of December 2020 the.

Our TravelMoneyMax tool compares 30 bureaux to max your holiday cash. You can edit. Excludes refinances from Bankwest and CommBank.

Keep in mind how much you can afford to borrow without putting the rest of your financial plans on hold. For borrowings up to 90 including lenders mortgage insurance of the property value. Contact New American Funding today to see how much you can save.

Just plug in your loan amount. How long would you like your mortgage for. At a 4 fixed interest rate your monthly mortgage payment on a 30-year mortgage might total 71612 a month while a 15-year term might cost a month.

This is probably one of the two biggest factors that determine how much you can afford. Cash out debt consolidation options available. How much can you borrow.

Thats about two-thirds of what you borrowed in interestIf you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. You must consider the homes price the amount of your deposit and how much you can set aside for monthly mortgage payments. Over 170000 positive reviews with an A rating with BBB.

While having fun with our mortgage calculator we. Or 4 times your joint income if youre applying for a mortgage. Monthly payments on a 150000 mortgage.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. An easy way to do the math and compare the payment amounts for a 106 ARM and 30-year fixed is with a mortgage payment calculator. Before you decide you should weigh the pros and cons of making a large down payment to see what is not only feasible for.

Please get in touch over the phone or visit us in branch. How long will I live in this home. Pay off higher interest rate credit cards pay for college tuition.

Monthly Debts Pre-Mortgage. Image for illustrative purposes only. Mortgage Rate 30-Year Fixed 3125.

This link is provided for convenience and informational purposes only and Horizon does not endorse and is. Most UK lenders consider 20 to 30 a low-risk range. Find out what you can borrow.

In reality its much more complex. Loan must be funded by 30 April 2023. How You Can Help Your Mortgage Close Quickly The web site you have selected is an external site not operated by Horizon Bank.

Contact New American Funding today to see how much you can save. Determine how much home you can afford with these helpful tips and questions to consider when budgeting for a mortgage. The most common loan terms are 15 and 30 years though there are other terms available.

The longer term will provide a more affordable monthly. Find and compare 30-year mortgage rates and choose your preferred lender. This is how much interest you pay if you keep the mortgage for 30 years and dont make any additional payments.

See how much you can borrow. Safis says the average rate difference between a 106 ARM and a 30-year fixed mortgage can be about 05 to 075. Most mortgage loans require a down payment of.

That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term. How much do houses cost. Borrow from 8 to 30 years.

So the value of the property can also limit how much you can borrow. If you borrow 400000 you will pay an additional 71870 in interest over 30 years. The average rate for a 30-year fixed mortgage dropped to 578 this week.

Note that your monthly mortgage payments. That said it may still make sense to pay the full 20 of the homes purchase price if possible.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

30 Loan Application Forms Jotform

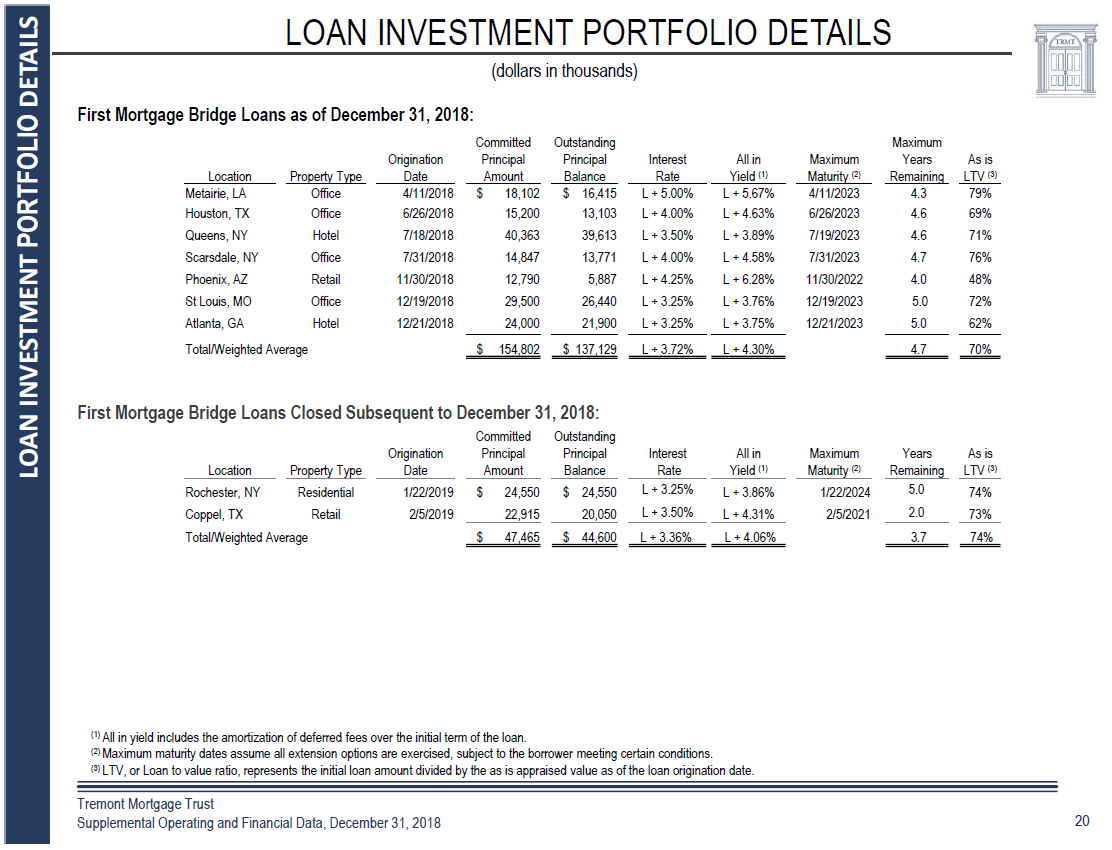

Tremont Mortgage Trust A Microcap Reit Turnaround That Offers A 16 Future Dividend Yield Or 70 Upside Nasdaq Sevn Seeking Alpha

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tougher Times For Home Loan Approvals Japan Property Central

Excel Ppmt Function With Formula Examples

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Line Of Credit Mobile Dashboard Line Of Credit Lending App Banking App

Tremont Mortgage Trust A Microcap Reit Turnaround That Offers A 16 Future Dividend Yield Or 70 Upside Nasdaq Sevn Seeking Alpha

Bringing It Home Raising Home Ownership By Reforming Mortgage Finance Institute For Global Change

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm